Sany Heavy Industry Co. (600031), the world's fifth largest construction machinery manufacturer whose stocks are included in the Morgan Stanley Emerging Markets (MSCI) Index, released its audited semi-annual financial statements on Monday, reporting a significant surge in its net profit during the first half of 2018.

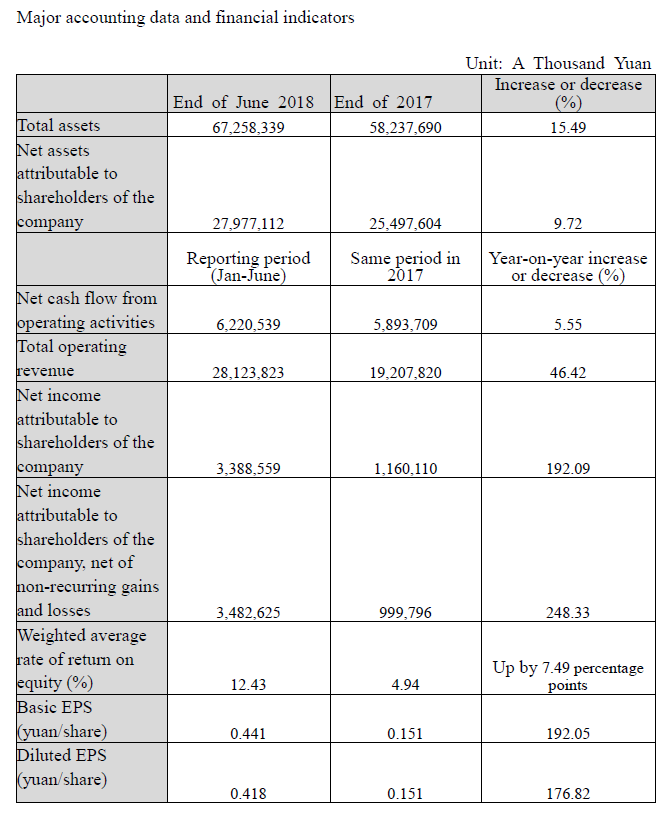

The company generated a total of over 28.12 billion yuan in operating revenue during the reporting period, a year-on-year growth of 46.42 percent. More strikingly, its net profit jumped by as much as 192.09 percent from a year earlier to hit nearly 3.39 billion yuan by the end of June.

The company saw its basic earnings per share rise by up to 192.05 percent year-on-year to 0.441 yuan while its weighted average rate of return on equity also climbed by 7.49 percentage points to 12.43 percent.

As a result of its robust business performance, the company's total assets surged by 15.49 percent from the beginning of this year to more than 67.25 billion yuan by the end of June.

During the reporting period, the company saw an increase in the sales of all of its major products, with the sales revenue from its concrete mixers growing by 29.36 percent to roughly 8.55 billion yuan, which ensured the company's dominance in the global market.

An increase of 61.62 percent in the sales revenue from its excavators also consolidated the company's status as the top seller in the domestic market over the past eight years.

It is worth noting that the company's overseas markets brought it 6.09 billion yuan in sales revenue during the period, a year-on-year growth of 5.05 percent.

What's more, by improving its financial structure, the company also enhanced its ability over risk control, with its debt-to-asset ratio staying at 56.99 percent.

Latest comments