BYD Co., one of China's most promising automakers, suffered a sharp decline in net profit during the first half of 2018, according to its audited semi-annual financial report released on Thursday.

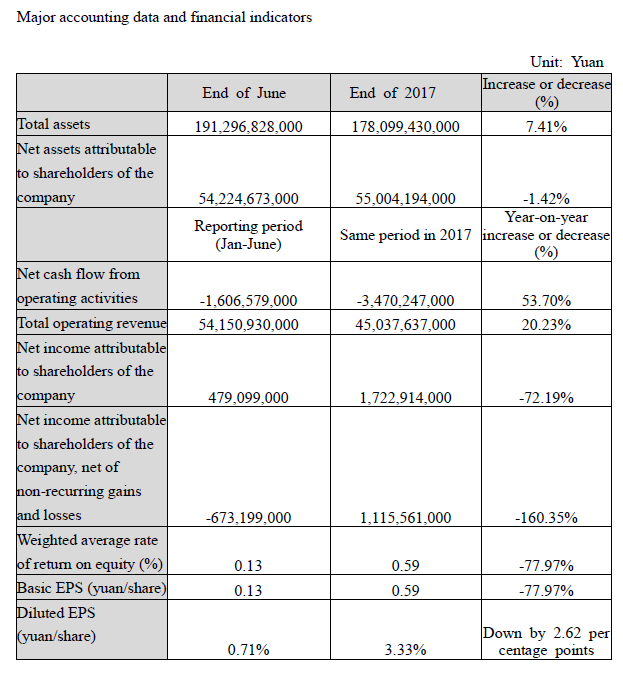

However, the company, with its stocks included in the Morgan Stanley Capital International (MSCI) Emerging Markets Index, generated a total of 54.15 billion yuan in operating revenue during the reporting period, a year-on-year increase of 20.23 percent.

As opposed to its robust revenue growth, the company's net profit fell by as much as 72.19 percent from a year earlier to 479 million yuan.

The company's weakened profitability was also reflected in its basic earnings per share which plunged by nearly 80 percent year over year to 0.13 yuan. Meanwhile, its weighted average rate of return on equity was down by 2.62 percentage points to 0.71 percent.

As the country's leading new energy vehicle (NEV) manufacturer, the company sold 75,800 NEVs in total during the reporting period, a number which not only more than doubled that for the same period last year but also led the global NEV market for the second year in a row.

Despite this rapid growth in the sales of its NEVs, the company cites a 30 percent reduction in the government subsidy for Chinese NEV manufacturers as the primary reason for its substantial profit loss, saying that the policy change will have a major impact on its profitability for the short term.

Since the new subsidy policy is aimed at encouraging the production of the NEVs with longer driving range and higher power density, the company believes that the majority of its NEV models are expected to enjoy the highest government subsidy under the new policy, which will in turn greatly boost its profitability over the second half of this year.

Latest comments