Contents Provided by Media OutReach

Highlights of Office Market:

- Rental decline slowing as leasing activity picks up,1-1.5% decline forecast in 4Q

- Positive net absorption of +327,700 sq. ft., first positive take-up since 3Q 2019. Trend expected to continue in 4Q.

- Surrender stock decreased by 12% q-o-q, whilst fitted and subsidized stock remains attractive to cost sensitive tenants

- Finance and Serviced Office sectors continued to lead office leasing recovery

- Availability rate decreased slightly to 13.9%, due to increase in leasing activity. Expected to remain stable in 4Q.

4Q transactions expected to centre around new supply pipeline and well-managed office portfolios- Local demand, mainly with Jewellery & Watches and Fashion & Accessories, drove retail sales up by 8.1% y-o-y, city retail sales expect to maintain momentum, supported by the 2nd disbursement of CVS

- High-street rents increased slightly in 3Q, overall rents set to stabilize in 4Q

- Vacancy rates adjusted downward in general, particularly in Mongkok

- F&B rents improves for two consecutive quarters, backed by new opening of local restaurants and beverage shops, F&B sector will continue to lead retail recovery

Insurance companies could become the next wave of retail leasing demandHONG KONG SAR - Media OutReach - 12 October 2021 - In-line with gradual recovery in the markets, office and retail leasing activity continued to pick up in 3Q 2021. The office market witnessed the first positive net absorption since 3Q 2019 while retail sales are up by 8.1% y-o-y. Office rental decline slowed in the quarter amidst considerable leasing activity in the Finance and Serviced Office sectors, whereas retail rents stayed flat. However, new office supply in decentralized submarkets completing in 2022 will significantly increase availability rates.

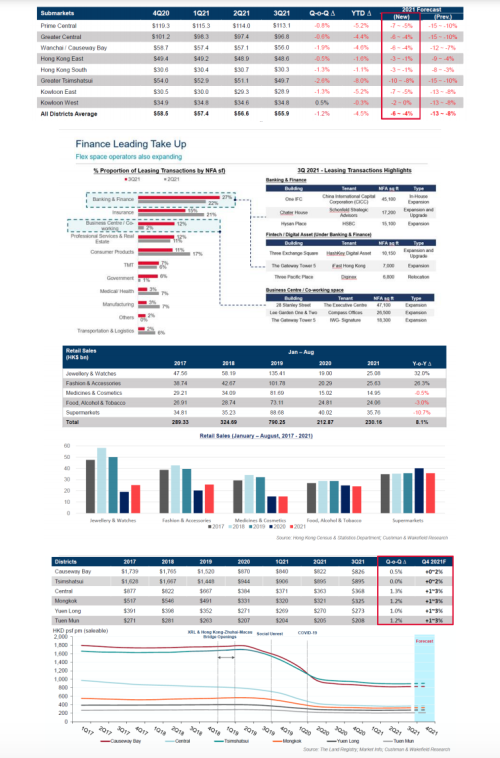

Table 1 - Hong Kong Office Rents Comparison (Source: Cushman & Wakefield Research)

Table 2 – Leasing Activity – Sector Breakdown (Source: Cushman & Wakefield Research)

Table 3 – Retail Sales Performance (Source: Hong Kong Census & statistic Department; Cushman & Wakefield Research)

Table 4 – F&B Rental Value Comparison (Source: The Land Registry; Market Info; Cushman & Wakefield Research)

Office Market – Rents decline remains mild in 3Q

With positive net absorption of 327,700 sq. ft. in 3Q 2021, the first positive take-up since 3Q 2019, the overall office space availability rate dipped slightly to 13.9% in 3Q 2021 and is expected to stabilize through to the end of 2021. High-quality fitted and subsidized surrender space remains attractive to cost sensitive tenants seeking to avoid capital expenditure. The decline in citywide rents slowed with a drop of 1.2% q-o-q, up from 1.4% q-o-q. (Table 1).

Mr. Keith Hemshall, Cushman & Wakefield's Head of Office Services, Hong Kong, commented,

"Compared to the relatively low levels of tenant movement in Q2, we saw a resurgence of transaction activity in Q3 with several notable deals concluded by tenants from the Banking & Finance (27%) ,Insurance (15%) and Business Centre / Co-working (12%) sectors. As a result, the amount of office space being surrendered dropped 12% q-o-q equating to a reduction of 62,000 sq. ft. in total".

Transaction highlights below (Table 2)

Mr. John Siu, Cushman & Wakefield's Managing Director, Hong Kong, commented, "With leasing activity picking up in various areas across Hong Kong and rising demand for business centre and co-working space, 3Q 2021 recorded the first positive net absorption of 327,700 sq. ft since 3Q 2019. However, significant new supply of 2.75m sq. ft launching into the decentralized submarketsin 2022 will raise the upcoming availability."

Retail Market – Sales of luxury goods performed better than necessities

With improving consumer sentiment, retail sales increased by 8.1% y-o-y. The increment was mainly driven by Jewellery & Watches (32%) and Fashion & Accessories (26.3%) sectors. Second disbursement of Consumption Voucher Scheme will likely give boost to the retail sales (Table 3).

Meanwhile, F&B sector continue to lead the retail recovery. Although F&B rents rose for 2 consecutive quarters, the overall rents only increased marginally in 3Q and it is set to stabilize in end-2021 (Table 4).

Mr. Kevin Lam, Cushman & Wakefield's Executive Director, Head of Retail Services, Hong Kong, said, " Retail space occupancy level also gradually improved in most districts. Mongkok and Central outperformed other districts with respective vacancy standing at 10.9% and 8.5%. On top of that, we are seeing more insurance companies actively expanding, aiming to engage with potential and existing customers further. We anticipate insurance service centers maybe an upcoming trend, taking advantage of the lowered retail rentals."

Please click HERE to download the event photos and slide deck..

Photo 1

Photo Caption 1: (From Left to Right) Mr Kevin Lam, Cushman & Wakefield's Executive Director, Head of Retail Services, Hong Kong, Mr John Siu, Cushman & Wakefield's Managing Director, Hong Kong and Mr Keith Hemshall, Cushman & Wakefield's Executive Director, Head of Office Services, Hong Kong

Photo 2

Photo Caption 2:(From Left to Right) Mr Kevin Lam, Cushman & Wakefield's Executive Director, Head of Retail Services, Hong Kong, Mr John Siu, Cushman & Wakefield's Managing Director, Hong Kong and Mr Keith Hemshall, Cushman & Wakefield's Executive Director, Head of Office Services, Hong Kong

www.cushmanwakefield.com

www.cushmanwakefield.com https://www.linkedin.com/company/cushman-&-wakefield-greater-china

https://www.linkedin.com/company/cushman-&-wakefield-greater-china

Latest comments