Contents Provided by Media OutReach

Insights from survey led to creation of AIA Pay Protector; first in market to offer a simplified disability income plan which provides fixed monthly payouts regardless of any sources of income received during disability and any changes to insured’s income level prior to disability, and claimable upon inability to specifically perform own occupation

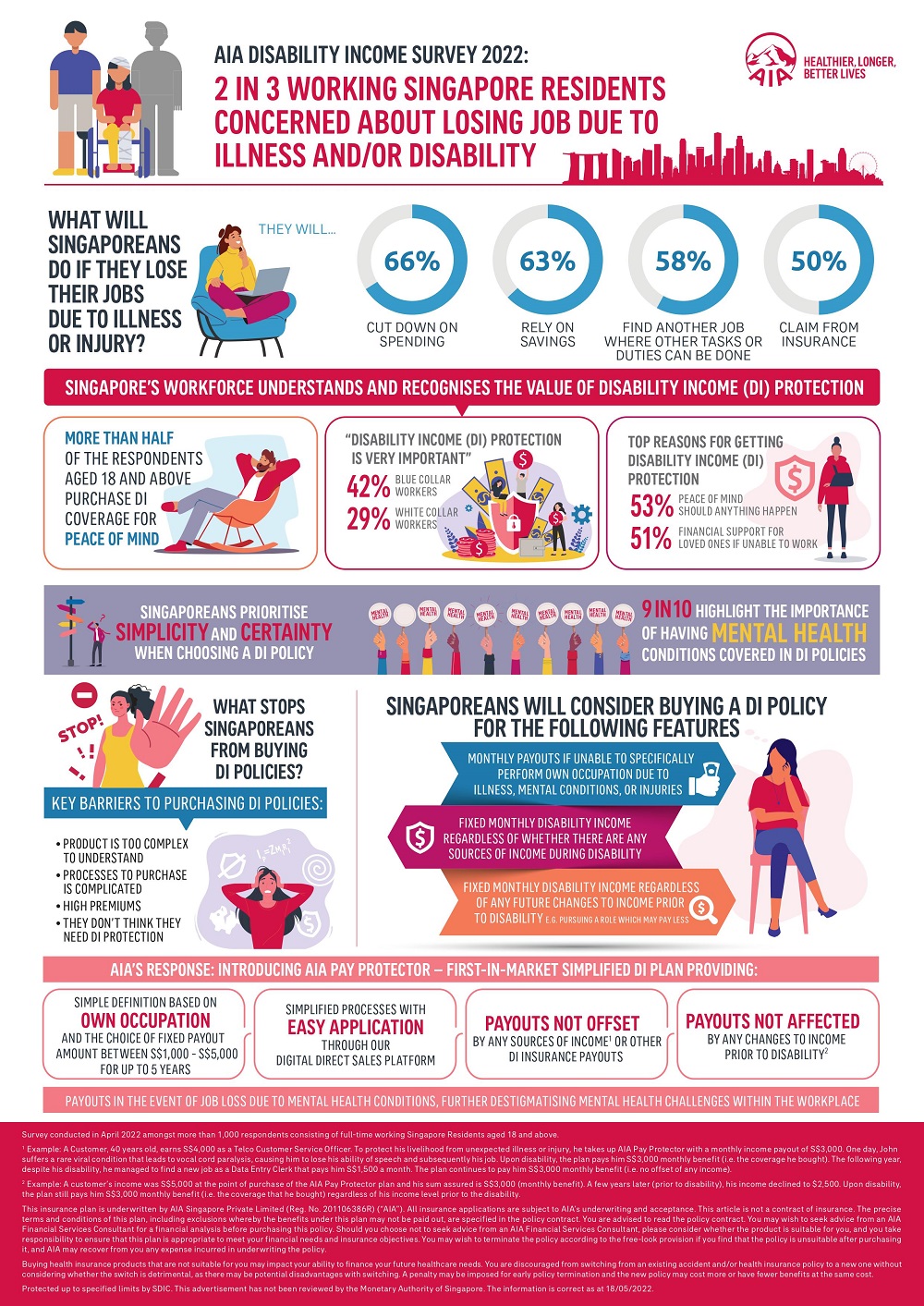

SINGAPORE - Media OutReach - 18 May 2022 - While two-thirds (66 per cent) of Singapore's local workforce are worried about job loss due to illness or disabilities, more than half (53 per cent) do not have any disability income protection, according to findings from the AIA Disability Income Survey 2022.

The survey, conducted in April 2022 amongst more than 1,000 respondents[1] consisting of full-time working Singapore Residents aged 18 and above, also revealed that:

- Our workforce understands and recognises the value of disability income protection.

- Aside from cutting down on spending (66%), the local workforce would look to survive the financial implications of a job loss due to an illness or injury by:

- Relying on savings (63%)

- Finding another job where other tasks or duties can be done (58%)

- Claiming from insurance (50%)

- More than 4 in 5 (84%) know that disability income protection exists though blue collar workers (42%) deem it to be very important to have such coverage compared to white collar workers (29%).

- Top 2 reasons for getting disability income (DI) protection are to have peace of mind should anything happen (53%), and to ensure that there is financial support for loved ones if unable to work (51%).

- More than half of the respondents aged 18 and above purchase DI coverage for peace of mind. From this group, those aged 45- 54 (52%) value DI coverage most for its ability to provide financial support for self and loved ones if unable to work.

- Aside from cutting down on spending (66%), the local workforce would look to survive the financial implications of a job loss due to an illness or injury by:

- Simplicity and certainty of payouts are top priorities when choosing a disability income policy.

- 9 in 10 highlight the importance of having mental health conditions covered in disability income policies.

- Most valued features of a disability income policy identified are:

- Monthly payouts if unable to specifically perform own occupation due to illness, mental conditions, or injuries (91%).

- Fixed monthly disability income regardless of whether there are any sources of income during disability[2] (90%).

- Fixed monthly disability income regardless of any future changes in income prior to disability e.g. pursuing a role which may pay less[3] (90%).

- Key barriers to purchasing disability income policies include product complexity, complicated processes and high premiums.

- 1 in 4 (25%) of females cite the cost of premiums as a reason for not having DI protection compared to less than 1 in 5 (16%) of males. This was the most selected reason amongst females.

- However, 22% of men said they did not have DI protection because they don't think they need it – the most selected reason amongst males. Only 13% of women chose this reason.

Melita Teo, Chief Customer and Digital Officer, AIA Singapore, said, "Losing one's job and becoming dependent on others due to an unexpected accident or illness is painful and places heavy financial and emotional burdens on a person and their loved ones. Understanding the pain points of disability income plans allows us to better address Singaporeans' concerns which range from affordability, to ease of getting insured and making a claim. These are key priorities which informed how we developed the AIA Pay Protector to make disability income protection accessible to even more members of the community."

In 2021, a Ministry of Manpower (MOM) report noted that workplace injuries have risen to pre-covid levels, with construction, transportation and storage sectors accounting for the highest number of fatalities[4]. The gap in disability income protection is a cause for concern, especially among blue-collared workers who are at a higher risk of disability due to the nature of their work.

AIA Pay Protector - first-in-market simplified disability income plan offers lower premiums, fixed monthly benefits regardless of income fluctuation or any sources of income and simplified processes

Designed with insights and feedback from customers and AIA Insurance Representatives, the AIA Pay Protector addresses key concerns and barriers around product complexity, vague definitions, and claims uncertainty arising from declaration of earnings and income fluctuation.

AIA Pay Protector is the first-of-its-kind in the market that promises payouts will not be offset by any sources of income or other disability income insurance payouts and will not be affected by any changes to income prior to disability, giving customers a peace of mind and ample support to reboot their careers while they recover from illness.

Customers can select their desired fixed monthly payouts from a range of $1,000 to $5,000[5] where benefits will be paid out for up to 5 years[6] in the event where they are unable to perform material duties of their own occupation due to illness or disability (physical or mental).

With fixed payouts, claim processes are streamlined and become more efficient due to the elimination of calculation when claims are eventually made.

AIA Pay Protector also provides payouts in the event of job loss due to mental health conditions, paving the way for destigmatising mental health within the workplace.

This echoes the growing focus on mental health and well-being amongst Singaporeans as they emerge from a prolonged pandemic. As a leading insurer, AIA Singapore recognises the need for the inclusion of mental health in different types of insurance coverage, and as a reason for job loss across occupations. In 2019, AIA Singapore is the first insurer to cover mental health in its critical illness plan, AIA Beyond Critical Care.

Irma Hadikusuma, Chief Product Proposition Officer, AIA Singapore, said, "It is important for us to recognise and help people address their protection gaps with simple, innovative solutions. The pandemic has accelerated the need for greater financial independence - regardless of whether you're single or have a family to care for. AIA Pay Protector responds to this demand by promising continuity of this independence with certainty of income in the short term for the unexpected event of job loss due to mental illnesses or physical disabilities."

Customers who are keen to apply for AIA Pay Protector can do so directly from My AIASG app or contact an AIA Insurance Representative. The hassle-free application process includes a simple medical history questionnaire that customers can fill out on their own. Customers are neither required to disclose their actual income amount nor submit their payslip in the process of application via our digital direct sales platform.

For more information on AIA Pay Protector, and AIA's comprehensive disability proposition, please visit: https://www.aia.com.sg/en/our-products/disability-income-protection/aia-pay-protector.html [7]

[2] Example: A customer, 40 years old, earns S$4,000 as a Telco Customer Service Officer. To protect his livelihood from unexpected illness or injury, he takes up AIA Pay Protector with a monthly income payout of S$3,000. One day, John suffers a rare viral condition that leads to vocal cord paralysis, causing him to lose his ability of speech and subsequently his job. Upon disability, the plan pays him S$3,000 monthly benefit (i.e. the coverage he bought). The following year, despite his disability he managed to find a new job as a Data Entry Clerk that pays him S$1,500 a month. The plan continues to pay him S$3,000 monthly benefit (i,e no offset of any income).

[3] Example: A customer's income was S$5,000 at the point of purchase of the AIA Pay Protector plan and his sum assured is S$3,000 (monthly benefit). A few years later (prior to disability), his income declined to $2,500. Upon disability, the plan still pays him S$3,000 monthly benefit (i.e. the coverage that he bought) regardless of his income level prior to the disability.

[4] 'Workplace injuries in the first half of 2021 comparable to pre-COVID-19 levels, but fatal accidents a 'cause for concern': MOM' (8 Oct, 2021). Channel News Asia. Ian Cheng. Available at: https://www.channelnewsasia.com/singapore/workplace-injuries-first-half-2021-pre-covid-19-levels-mom-2230331

[5] Customers can pick and choose the fixed monthly payout they would like to receive from 5 packages, where monthly benefit is fixed at $1,000, $2,000, $3,000, $4,000 and $5,000, subject to 75% income replacement ratio of their average monthly income in the last 12 months.

[6] Subject to a 90-days deferment period.

[7] This insurance plan is underwritten by AIA Singapore Private Limited (Reg. No. 201106386R) ("AIA"). All insurance applications are subject to AIA's underwriting and acceptance. This article is not a contract of insurance. The precise terms and conditions of this plan, including exclusions whereby the benefits under this plan may not be paid out, are specified in the policy contract. You are advised to read the policy contract. You may wish to seek advice from an AIA Financial Services Consultant for a financial analysis before purchasing this policy. Should you choose not to seek advice from an AIA Financial Services Consultant, please consider whether the product is suitable for you, and you take responsibility to ensure that this plan is appropriate to meet your financial needs and insurance objectives. You may wish to terminate the policy according to the free-look provision if you find that the policy is unsuitable after purchasing it, and AIA may recover from you any expense incurred in underwriting the policy.

Buying health insurance products that are not suitable for you may impact your ability to finance your future healthcare needs. You are discouraged from switching from an existing accident and/or health insurance policy to a new one without considering whether the switch is detrimental, as there may be potential disadvantages with switching. A penalty may be imposed for early policy termination and the new policy may cost more or have fewer benefits at the same cost.

Protected up to specified limits by SDIC. This advertisement has not been reviewed by the Monetary Authority of Singapore.

The information is correct as at 18/05/2022.

About AIA

The business that is now AIA was first established in Shanghai more than a century ago in 1919. It is a market leader in Asia (ex-Japan) based on life insurance premiums and holds leading positions across the majority of its markets. It had total assets of US$340 billion as of 31 December 2021.

AIA meets the long-term savings and protection needs of individuals by offering a range of products and services including life insurance, accident and health insurance and savings plans. The Group also provides employee benefits, credit life and pension services to corporate clients. Through an extensive network of agents, partners and employees across Asia, AIA serves the holders of more than 39 million individual policies and over 16 million participating members of group insurance schemes.

1. Hong Kong SAR refers to Hong Kong Special Administrative Region.

2. Macau SAR refers to Macau Special Administrative Region.

#AIA

The issuer is solely responsible for the content of this announcement.

Latest comments