Goldman Sachs Asset Management expects to see improving economic conditions in emerging markets over the coming months, thus providing a springboard for the value of regional stocks and currencies.

Emerging market currencies have been under pressure throughout much of 2018, on the back of a stronger U.S. dollar that is trading up almost 5 percent against a basket of six major currencies this year.

But, the CEO for EMEA and Global Head of Fixed Income at Goldman Sachs Asset Management told CNBC on Tuesday that while the dollar has performed well year-to-date, financial markets have probably "seen the best of it."

"I guess if we go into next year, we would see many emerging market currencies in particular, many of which have underperformed significantly in 2018, having a bounce back," Andrew Wilson told CNBC's "Street Signs" on Tuesday.

The greenback stood at around 96.851 against a basket of rivals at around 1:10 p.m. London time.

'Attractive return potential' for EM assets

In a report published last week, analysts at Goldman Sachs Asset Management predicted a "renewed outperformance" of emerging market assets relative to developed markets as global growth rebalances.

"We see attractive return potential for emerging market assets in 2019, particularly in currencies and equities, which we expect to be unleashed by improving growth," analysts at Goldman Sachs Asset Management said in its investment outlook for next year.

"Emerging markets are trading at an attractive 25 percent discount to developed market equities, while offering potentially higher expected earnings growth," they added.

Market participants are increasingly worried about a possible economic slowdown, with global stocks tumbling shortly before the U.S. Federal Reserve's final two-day meeting of the calendar year.

The U.S. central bank is widely expected to deliver its fourth interest rate hike of 2018 on Wednesday, despite mounting speculation the Fed could be tempted to pause its tightening cycle amid signs of economic turbulence in the world's largest economy.

On Monday, President Donald Trump and his top trade advisor, Peter Navarro, slammed the Fed for its monetary tightening. The comments appeared to fuel investor anxiety ahead of the central bank's much-anticipated meeting.

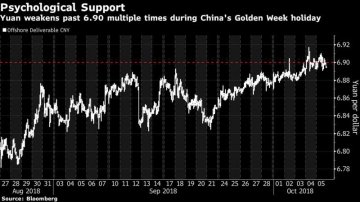

China stands out as the 'biggest risk' to EM assets

Despite the latest wave of heavy selling in equity markets, analysts at Goldman Sachs Asset Management have previously said that they remain "pro-risk heading into 2019."

"Asset prices and market expectations have adjusted significantly lower versus a year ago, offering a better deal and creating the potential for positive surprises."

Goldman Sachs warned the "biggest risk" to their investment outlook for next year was the economic performance of China over the coming months.

"Our 2019 forecast for 6.2 percent growth would mark the slowest pace of Chinese growth since the early 1990s," analysts at the bank said earlier this month.

"However, we think the period of the highest intensity of growth deceleration is behind us, meaning there is less near-term pressure for the rest of the EM countries to offset."

Latest comments