As the predominant task of China’s economic structural reform, de-capacity was first carried out in the coal and iron & steel sectors this February. But up till the end of July, only 38 percent and 47 percent of the target were realized in these two sectors respectively, and the achievements of different regions varied. The Economic Information Daily learnt that the central government has issued orders consecutively to strengthen de-capacity, and required local regions and SOEs to complete the goal by the beginning and end of November respectively, ahead of the schedule.

As the predominant task of China’s economic structural reform, de-capacity was first carried out in the coal and iron & steel sectors this February. But up till the end of July, only 38 percent and 47 percent of the target were realized in these two sectors respectively, and the achievements of different regions varied. The Economic Information Daily learnt that the central government has issued orders consecutively to strengthen de-capacity, and required local regions and SOEs to complete the goal by the beginning and end of November respectively, ahead of the schedule.Industry insiders believe that China faces many difficulties in absorbing excessive capacity in the second half year. As the wave of shutting down of overcapacity enterprises is expected to come in September, pressure on personnel resettlement and exposure of non-performing loans will increase. It is said that relevant authorities are studying and formulating specific implementing measures aiming at promoting merging and restructuring, debt restructuring, liquidation and etc., to address the debt issues of closed enterprises with overcapacity according to law and rules.

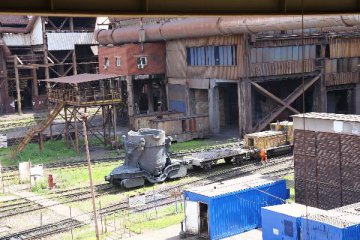

According to the Guiding Opinions on Absorbing Excessive Capacity in the Coal and Iron & Steel Industries issued by the State Council, China will spend three to five years in shutting down coal capacity of about 500 million tons, cutting and restructuring capacity of about 500 million tons. The target of de-capacity of crude steel is to cutting 100 to 150 million tons within five years. The goal in this year is to cut capacity of 250 million tons and 45 million tons of coal and iron & steel respectively.

It is learnt that Hunan province and Jiangsu province has completed nearly 80 percent of the annual de-capacity goal. Other five provinces and municipalities including Beijing have completed over 50 percent of the goal. But other four provinces such as Inner Mongolia, as well as Xinjiang Production and Construction Corps made no substantial progress in cutting overcapacity; other three provinces such as Jiangxi completed less than 10 percent of the goal. Local regions mostly put 50 percent of the annual goal in the fourth quarter, and particularly more than one third are left in December, thus most of the tasks are concentrated at the year end, and it is highly probable that such tasks cannot completed.

De-capacity of iron & steel is quite similar. As of the end of July, only 47 percent of the annual target is finished. Four provinces such as Zhejiang are among the first to have completed the yearly target. Other eight provinces such as Hebei have completed 10 percent to 35 percent. Chongqing municipality has completed 2.3 percent. Ten provinces such as Inner Mongolia as well as Xinjiang Production and Construction Corps have not yet started relevant works.

The overcapacity absorption of iron & steel and coal industries and inter-ministry joint conference held recently clearly proposes to fully complete the yearly goal of de-capacity of coal by the end of November, and central state-owned enterprises and provincial state-owned coal enterprises should strive to complete the task at the beginning of November.

Local governments accelerated the pace of de-capacity with clear signals from the central government.

As a province with rich coal resources, Heilongjiang also introduced implementing plans at the end of July to cut overcapacity of coal. Heilongjiang plans to close down 44 coal mines and cut 25.67 million tons (outside the province: 0.45 million tons) of coal capacity in three to five years from the beginning of 2016. The key point of Heilongjiang is Heilongjiang Longmay Mining Holding Group Co., Ltd., which involves overcapacity of 18.14 million tons and resettlement of 50,000 personnel.

The latest financial report shows that Longmay Holding Group recorded loss of 1 billion yuan in the first quarter. “The reform has come to a crucial stage. Though the group currently operates smoothly, given the contradictions accumulated over the years and the weak prices of coal across the country, the pressure on maintaining normal operation and reasonable cash flow has not fundamentally eased. Problems in reposition of redundant personnel and business operation are highlights,” a grassroots cadre from the company told the Economic Information Daily.

The case is not alone. According to the plan made by Shanxi province, a coal capacity of 20 million tons will exit this year. 21 coal mines under six state-owned large-scale coal groups will be shut down. “The target mines have almost been shut down now, and equipment will be dismantled later for complete exit. The deadline is set at end November.” A person in charge of publicity with Jinneng Group Co., Ltd. told the journalist that the main and also the hardest work in the future is the resettling of personnel.

Following the meetings held on Aug. 3 and 4 appealing to greater efforts in cutting capacity of coal and iron & steel, Shanxi printed and distributed the Implementation Opinions about the Resettling of Redundant Personnel in Coal and Iron & Steel Industries, proposing to resettle employees through various channels.

Another problem awaits settlement is the several trillion yuan debts. According to the introduction made by the person in charge of the Changsha branch of the People's Bank of China, a net decrease of 1.06 billion yuan medium- and long-term loan is seen in key de-capacity industries with coal and iron & steel included in the first half, a further decrease of 890 million yuan from that of the same period in 2015. But de-capacity might shortly lead to production halts of enterprises, lending suspension of banks and etc., further deteriorating the pressure exposed by non-performing loans.

It is learnt that the China Banking Regulatory Commission (CBRC) is now taking advices for the Opinions about the Disposal of the Financial Claim, Debts and Overcapacity of Coal and Iron & Steel Industries. Local areas are also making attempts. Shanxi CBRC proposes to change original short-term working capital loans into medium- and long-term special-purpose loans.

Translated by Adam and Jennifer

Latest comments