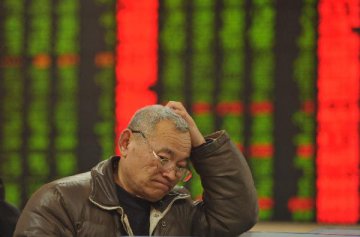

Chinese stocks closed mixed on Wednesday with the main index rising for the third consecutive trading day, advanced by construction materials and the retail sector.

The benchmark Shanghai Composite Index gained 0.24 percent to 3,261.22 points.

The smaller Shenzhen index closed 0.37 percent higher at 10,444.38points.

The ChiNext Index, China's NASDAQ-style board of growth enterprises, edged down 0.06 percent to close at 1,919.97 points on Wednesday after gaining 1.38 percent on Tuesday.

Combined turnover on the two bourses expanded to about 502.2 billion yuan (about 73 billion U.S. dollars) from 480.1 billion yuan the previous trading day.

Construction materials, liquor, and retail shares led the rally. Bailian Group gained 2.24 percent to 20.04 yuan per share, after the Shanghai-based retail conglomerate announced on Monday a strategic alliance with China's e-commerce giant Alibaba.

Kweichow Moutai rose 0.88 percent to 361.89 yuan, while Wuliangye Yibin, another famous Chinese liquor brand, gained 1.03 percent to 41.28 yuan.

China Shenhua Energy, the leading coal producer, lost 0.69 percent to 17.17 yuan, with China National Coal Association forecasting Tuesday that China's coal demand would continue to shrink in 2017.

Fujian Cement surged by the daily limit of 10 percent to 14.27 yuan per share. Shandong Iron and Steel rose 2.77 percent to 2.97 yuan.

China's top economic planner approved 18 large fixed asset investment projects with investment totalling 153.9 billion yuan last month, amid efforts to stabilize economic growth by boosting infrastructure investment.

Securities brokerages and other financial heavyweights led Wednesday's losses. Central China Securities lost 3.76 percent to 10.49 yuan.

Fifteen Chinese listed brokerages have estimated profit declines for the last year as thin stock trading dragged down their incomes in commission fees.

Latest comments