The Dow Jones Industrial Average rose 78.84 points, or 0.20 percent, to 38,886.17. The S&P 500 sank 1.07 points, or 0.02 percent, to 5,352.96. The Nasdaq Composite Index shed 14.78 points, or 0.09 percent, to 17,173.12, retreating from its all-time high reached a day earlier.

Eight of the 11 primary S&P 500 sectors ended in green, with consumer discretionary and energy leading the gainers by going up 0.97 percent and 0.55 percent, respectively. Meanwhile, utilities and industrials led the laggards by dropping 1.03 percent and 0.60 percent, respectively.

U.S. Treasury yields finished lower for a sixth straight session, producing the longest stretch of declines in long-term rates in more than a year, amid growing concerns about U.S. economic weakness. The 10- and 30-year yields ended at 4.285 percent and 4.432 percent, respectively, as of 4:25 p.m. EDT. The six-day stretch of declines seen as of Thursday is the longest such streak since the six- and seven-day periods that ended on April 5-6, 2023.

Meanwhile, Wall Street is anticipating Friday's nonfarm payrolls report for May, as investors seek signs of a weakening labor market that could justify rate cuts from the Federal Reserve. Economists polled by Dow Jones predict a gain of 190,000 jobs.

"To me, the market is still saying the economy is fine and not printing anything recessionary," said Ross Mayfield, investment strategy analyst at Baird. "But it could be the case that the Fed has already been too tight for too long and the momentum of a cooling job market will be hard to stop once it starts."

The report follows the European Central Bank's rate cut on Thursday, its first since 2019, which has increased pressure on the Federal Reserve to potentially ease its policy stance. The Fed is expected to keep rates unchanged in its meeting next week, although expectations for a rate cut in September are rising.

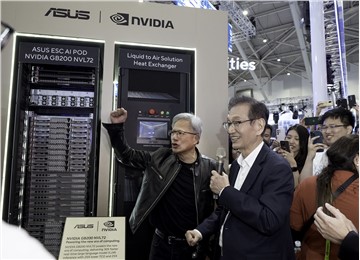

On the corporate front, Lululemon gained 4.8 percent after exceeding expectations in its fiscal first quarter. Meanwhile, Five Below dropped by 10.6 percent due to lackluster results and guidance. Nvidia, the chipmaker, declined by 1.18 percent, cooling off from record highs earlier in the week.

GameStop shares surged again on Thursday, rising 47.45 percent, after Roaring Kitty's YouTube channel showed signs of activity for the first time in three years. The account, associated with meme-stock pioneer Keith Gill, announced a livestream set to begin at noon Eastern time on Friday. AMC Entertainment also saw a significant jump, climbing up 12.4 percent.

Latest comments