Contents Provided by Media OutReach

Third set of guidelines by the Insurance Culture and Conduct Steering Committee (ICCSC) to elevate quality of financial advisory services as demand for protection, investments and savings grows

SINGAPORE - Media OutReach - 21 April 2022 - The Insurance Culture and Conduct Steering Committee (ICCSC) recently released its third paper 'Intermediary Culture and Conduct Best Practices – Promoting Ethical Culture and Conduct in Insurance Intermediaries (Life)' [1] as part of the Committee's continued efforts to elevate the culture and conduct standards of the life insurance ecosystem in Singapore by focusing efforts on people, performance, and processes. The first two papers focusing on Human Resources and Corporate Governance were released in March 2022.[2]

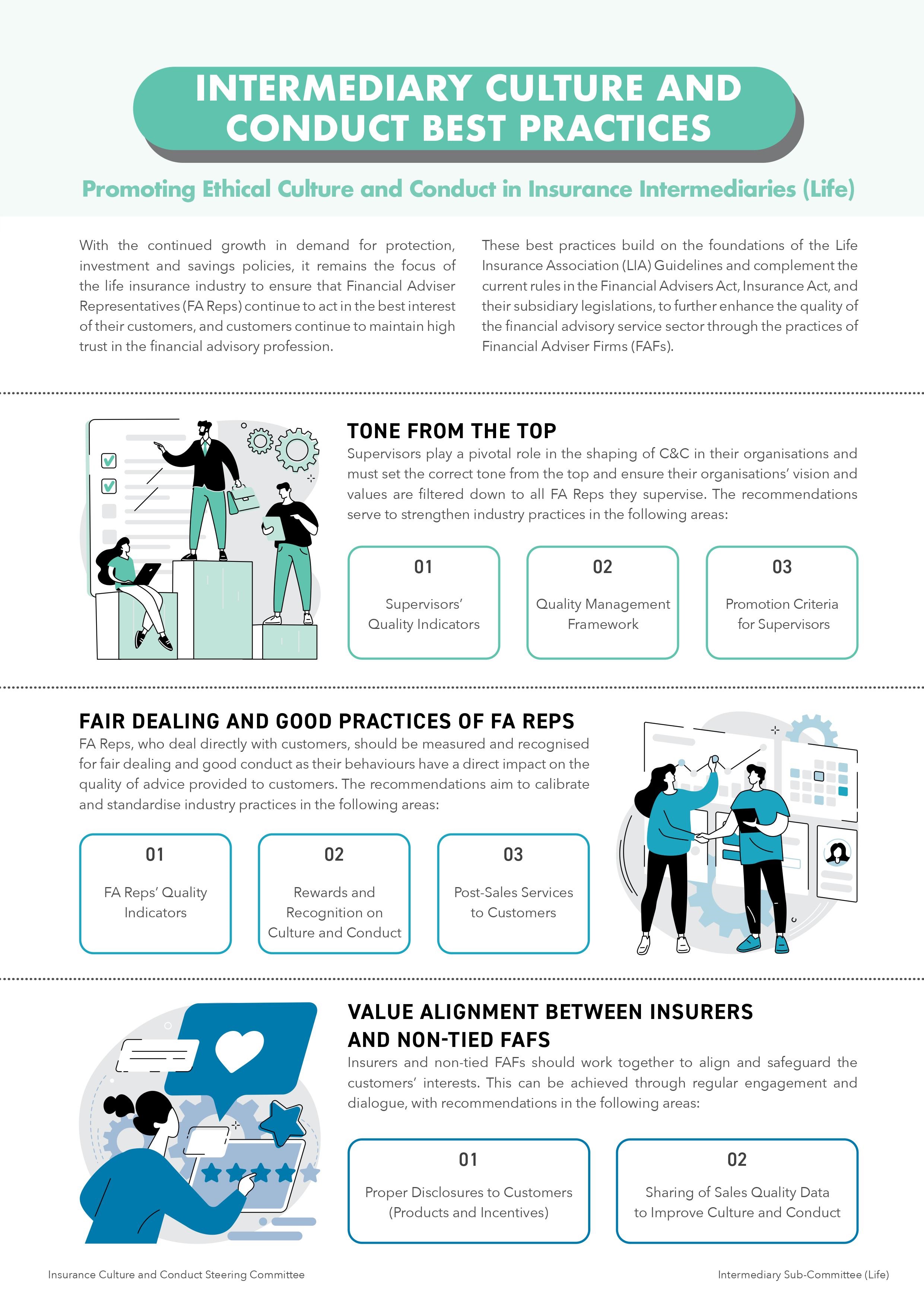

This third paper for Life Intermediaries aims to enhance the quality of financial advisory service sector through the practices of FA Reps and FAFs by providing:

- Guidance on the role of supervisors in setting the right tone from the top to ensure accountability from leadership that priorities are not only placed on achieving sales and revenue growth. Recommendations are aimed at strengthening industry practices in the three key areas of Supervisors' Quality Indicators, Quality Management Framework, and Promotion Criteria for Supervisors.

- Best practices on establishing key performance measures that effectively encourage FA Reps to provide customers with high quality financial advisory services. Guidelines focus on calibrating and standardising industry practices in the areas of FA Reps' Quality Indicators, Rewards and Recognition on Culture and Conduct, as well as Post-Sales Services to Customers.

- Collaboration on enhanced disclosures to customers and information sharing between insurers and non-tied Financial Advisory Firms (FAFs) to align and protect customers' interests through regular engagements and dialogues with recommendations centred on Proper Disclosure to Customers on Products and Incentives, as well as the Sharing of Sales Quality Data to improve Culture and Conduct.

"This is an extension of the first two papers with a specific focus on intermediaries within the life insurance eco-system – from FA Reps to FAFs. Our aim is to enhance professionalism within the industry more consistently and elevate the standard of care for customers in the advisory process," said Dr Khoo Kah Siang, Chairperson of the Insurance Culture and Conduct Steering Committee (ICCSC).

These best practices build on foundations of the Life Insurance Association Guidelines and complement current rules in the Financial Advisers Act, Insurance Act, and their subsidiary legislations.

The committee, consisting of senior leaders in the industry, was established in December 2019 to foster sound culture and strengthen standards of conduct among insurers in Singapore. [3] They are supported by the General Insurance Association of Singapore (GIA), the Life Insurance Association (LIA) and the Singapore Reinsurers' Association (SRA).

Appendix: Infographic on Intermediary Culture and Conduct Best Practices – Promoting Ethical Culture and Conduct in Insurance Intermediaries (Life)

for Insurance Industry (Dec 12, 2019). Information available at:

https://www.sgpc.gov.sg/sgpcmedia/media_releases/mas/press_release/P-20191212-1/attachment/Joint%20Media%20Release%20-%20New%20Industry%20Steering%20Committee%20to%20Elevate%20Culture%20and%20Conduct%20Standards%20for%20Insurance%20Industry.pdf

Latest comments