[Today's Guide]

○ China's first home-made aircraft carrier forming main body, industrial chain will grow

○ Opinions on development of rehabilitation equipment released, land transfer speeds up

○ Sunwin Intelligent to buy Kaixinren Information Technology, Pearl River Holdings to purchase BGG

○ Success Electronics proposes to acquire medical assets, CSF increased shareholding of several companies in Q3

[SSN Focus]

○ China's first home-made aircraft carrier forming main body, industrial chain will grow

------

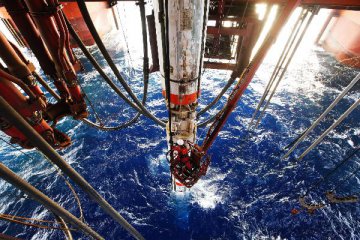

Spokesman for the Ministry of National Defense said on Oct. 27 that the development work China's first domestic aircraft carrier is on progress. Its design has completed. Its main body has been forming. The installation and outfitting is on the way.

Comment: Formation of aircraft carrier is a huge systematic work. Based on foreign experience, it would cost more than 20 billion US dollars to build Nimitz-class aircraft carrier. The project will involve ships, aviation, aerospace, weapons, electronics and other fields, which will greatly drive the industrial chain.Among A-share companies, China Shipbuilding Industry Company Limited (601989.SH) acquired "large surface ships" and other major military equipment assembly business. CSSC Offshore & Marine Engineering (Group) Company Limited (600685.SH) acquired Huangpu Wenchong military shipbuilding base in southern China. The products of China Avionics Systems Co., Ltd. (600372.SH) are widely used in military aircraft and other military equipment.

[SSN Selection]

○ The Sixth Plenary Session of the 18th Central Committee of the Communist Party of China (CPC) puts forward the "CPC Central Committee with Xi Jinping as core."

○ The National Development and Reform Commission (NDRC) indicates on Oct. 27 that China will build a traditional infrastructure PPP project information platform that connects all regions and departments.

○ Jiangsu Province is preparing to build the second provincial AMC in Suzhou to accelerate the treatment of non-performing assets. Leading shareholders are still local state-owned companies.

○ China-Boeing Aviation Industry Cooperation Forum is held on Oct. 27. Boeing signed supply agreement with Shandong Nanshan Aluminium Co., Ltd. (600219.SH) and other companies.

○ Sichuan Lutianhua Company Limited (000912.SZ) and Jiangxi Huangshanghuang Group Food Co., Ltd. (002695.SZ) announces suspending trading from Oct. 28 as their stock prices have surged.

TOP

[Industry Information].

○ Opinions on development of rehabilitation equipment released, industry expected to see rapid growth

------

The State Council on Oct. 27 issued the opinions on accelerating the development of rehabilitation aid equipment industry. It suggests that by 2020, the rehabilitation aid equipment industry should make significant improvement in the capability of independent innovation. The industry scale should exceeded 700 billion yuan. A number of well-known domestic brands and advantageous industrial clusters should emerge. Its share in the high-end market should significantly increase. It also proposes to promote the combination of medial and industry, support integrated application of artificial intelligence, brain-computer interface, virtual reality and other new technologies in rehabilitation aids equipment, and support the research and development of exoskeletal robots, care and rehabilitation robots, bionic prosthetics, virtual reality rehabilitation training equipment and other products.

Comment: The State Council executive meeting held on Oct. 14 proposed to encourage to gradually include basic rehabilitation aid equipment into the scope of basic health insurance payment. Institutions believe that as medical concepts update fast, rehabilitation equipment will become the fastest-growing one among all medical sub-sectors, and is expected to maintain more than 40% growth rate in the coming two years. HL Corp (Shenzhen) (002105.SZ) has prominent technical advantages in rehabilitation equipment. It cooperates with three major international rehabilitation equipment brands. Guangdong Jinming Machinery Co., Ltd. (300281.SZ) works with Tsinghua University to develop rehabilitation robots. Chongqing Dima Industry Co., Ltd. (600565.SH) to increase investment in exoskeleton robots.

○ Land transfer speeds up, rural land resources show values

------

The State Council recently released the national plan for agricultural modernization (2016-2020). The plan proposes to deepen the agricultural and rural reform, accelerate in promoting the registration and certification for rural contracted land right while stably improving basic operation system in rural areas, and strive to complete the reform by the end of 2018. The plan also proposes that it will improve the system on the operation management in villages in all counties and promote the management services on land transfer and scaled operation. It will actively develop operations with moderate scales in various forms, guide farmers in voluntary and orderly transfer of the operation right on lands and support the development of operations with moderate scales through land transfer and other means.

Comment: Driven by the confirmation on land right and the agricultural scaled operation, the land transfer will speed up and enterprises with land resources will see more market opportunities. Anhui Huilong Agricultural Means of Production Co., Ltd. (002556.SZ) is a leader in the trading of agricultural materials and is actively participating in land transfer. Gansu Yasheng Industrial (Group) Co., Ltd. (600108.SH), China Hainan Rubber Industry Group Co., Ltd. (601118.SH) and Heilongjiang Agriculture Company Limited (600598.SH) own huge agricultural land resources.

TOP

[Announcement Interpretation]

○ Sunwin Intelligent to buy Kaixinren Information Technology with RMB 1,085 mln

------

Shenzhen Sunwin Intelligent Co., Ltd. (300044.SZ) proposes to buy the entire equities of Beijing Kaixinren Information Technology Co., Ltd with 1,085 million yuan, which will be satisfied by cash payment of 322 million yuan and fundraising of 763 million yuan through issuing shares at 13.09 yuan per share. At the same time, the company proposes to raise supporting fund of 540 million yuan. Kaixinren Information Technology is a comprehensive Internet interactive entertainment company. It developed various social games such as Parking War, Friends for Sale, Happy Farm and Fun City. The original shareholder committed that net profits of Kaixinren Information Technology from 2016 to 2019 will be no less than 73 million yuan, 93 million yuan, 116 million yuan and 140 million yuan respectively.

○ Pearl River Holdings to purchase BGG

------

Hainan Pearl River Holdings Co., Ltd. (000505.SZ) proposes to replace part of the assets and liabilities for the entire equities of Beijing Grain Group Co., Ltd. (BGG). The valuations of the exchange-out and exchange-in assets approximates 600 million yuan and 2,419 million yuan respectively. The difference will be acquired through private placement at 8.09 yuan per share. At the same time, the company proposes to raise 600 million yuan supporting fund by issuing shares to BGG through private placement at 8082 yuan per share. BGG is primarily engaged in the process of vegetable oil and food manufacturing. The company's revenue and net profits for 2015 were 14.3 billion yuan and 130 million yuan respectively. It committed net profits from 2016 to 2018 will be no less than 124 million yuan, 141 million yuan and 160 million yuan respectively.

TOP

○ Success Electronics proposes to acquire medical assets

------

Shenzhen Success Electronics Co., td. (002289.SZ proposes to transfer the entire equities of Shenzhen Yassy Technology Co., Ltd. to Guangdong Hua long photoelectricity Technology Ltd. at the valuation ranges from 160 million yuan to 180 million yuan, which is higher than the asking price of 120 million yuan. Previously the company tried three times to clear the assets but not succeeded. Meanwhile, the company proposes to acquire 60 to 65 percent of medical supplies and equipment related assets at an estimated valuation of 540 million yuan to 715 million yuan.

○ CSF increased shareholding of several companies in Q3

------

The Q3 reports show that China Securities Finance Co., Ltd. (CSF) has increased holding about 20 million shares of China Eastern Airlines Corporation Limited (600115.SH) in Q3, and shareholding ratio was up from 2.33 percent to 2.47 percent; the CSF also increased holding 18 million shares of China Life Insurance Company Limited (601628.SH) in Q3, and the shareholding ratio was up from 2.03 percent to 2.09 percent. In addition, the CSF also increased shareholding in China National Nuclear Power Co., Ltd. (601985.SH) and Air China Limited (601111.SH).

○ Evergrande Life's shareholding in Integrated Electronic Systems Lab close to 5 percent threshold

------

Integrated Electronic Systems Lab Co., Ltd. (002339.SZ) disclosed in the Q3 report that in the latest list of shareholders, Evergrande Life has held 4.96 percent equities of the company through two accounts, namely Traditional Portfolio A and Universal Portfolio B, closing to the 5 percent threshold. In the interim report, Evergrande Life was not among the top 10 shareholders' list. Besides, Q3 report of Wuhan Zhongyuan Huadian Science & Technology Co., Ltd. (300018.SZ) shows that Evergrande Life's Traditional Portfolio A and B in total held 4.95 percent of the company's equities.

○ Q3 report of Guoguang Electric Company Limited (002045.SZ) shows that in the list of top 10 shareholders, BOCOM& Schroders has taken 6 seats, with total shareholding ratio of 7.93 percent.

○ Beijing Shouhang Ihw Resources Saving Technology Co., Ltd. (002665.SZ) has signed three big orders with total amount of 218 million yuan. The company's revenue for 2015 was approximate 1,130 million yuan.

[Financial Reports Express]

○ Neoglory Prosperity expects growth

------

Neoglory Prosperity Inc. (002147.SZ) expects 411 to 446 times growth in its annual report, primarily due to property development has become the main profit source after restructuring. Zhejiang NHU Company Ltd. (002001.SZ) expects 2 times growth in its annual report, primarily due to rise of selling price. Jiangsu Huaxicun Co., Ltd. (000936.SZ) expects over 5 times growth in its annual report, primarily due to sharp increase of investment return. Shan Dong Sun Paper Industry Joint Stock Co., Ltd. (002078.SZ) expects about 1 time growth in its annual report, primarily due to the release of production capacity. Sansteel Minguang Co. ,Ltd., Fujian (002110.SZ) expects to significantly turn deficit into profit, primarily due to the pickup of demand for steel. Henan Billions Chemicals Co., Ltd. (002610.SZ) expects 2 to 3 times growth in its annual report, primarily due to the price hike of titanium dioxide. Qingdao Haili Metal One Co., Ltd. (002537.SZ) expects 1 to 2 times growth in its annual report, primarily due to combining Union Mobile Finacial Technology Co., Ltd. (UMF) into its financial statements.

[Trading Alarm]

○ CCIC and Oriental Zhongke Integration Technology IPO to debut from Oct. 28

------

China Building Material Test & Certification Group Co., Ltd. (CTC, 732060.SZ) will offer for subscription at 10.04 yuan per share, representing PE ratio of 22.97 times. The upper limit of subscription is 22,000 shares. The company is primarily engaged in the test and certification of construction materials. Beijing Oriental Zhongke Integration Technology Co., Ltd. (002819.SZ) will offer for subscription at 4.96 yuan per share, representing PE ratio of 22.95 times. The upper limit of subscription is 11,000 shares. The company is primarily engaged in electronic measuring instrument.

TOP

○ China's first home-made aircraft carrier forming main body, industrial chain will grow

○ Opinions on development of rehabilitation equipment released, land transfer speeds up

○ Sunwin Intelligent to buy Kaixinren Information Technology, Pearl River Holdings to purchase BGG

○ Success Electronics proposes to acquire medical assets, CSF increased shareholding of several companies in Q3

[SSN Focus]

○ China's first home-made aircraft carrier forming main body, industrial chain will grow

------

Spokesman for the Ministry of National Defense said on Oct. 27 that the development work China's first domestic aircraft carrier is on progress. Its design has completed. Its main body has been forming. The installation and outfitting is on the way.

Comment: Formation of aircraft carrier is a huge systematic work. Based on foreign experience, it would cost more than 20 billion US dollars to build Nimitz-class aircraft carrier. The project will involve ships, aviation, aerospace, weapons, electronics and other fields, which will greatly drive the industrial chain.Among A-share companies, China Shipbuilding Industry Company Limited (601989.SH) acquired "large surface ships" and other major military equipment assembly business. CSSC Offshore & Marine Engineering (Group) Company Limited (600685.SH) acquired Huangpu Wenchong military shipbuilding base in southern China. The products of China Avionics Systems Co., Ltd. (600372.SH) are widely used in military aircraft and other military equipment.

[SSN Selection]

○ The Sixth Plenary Session of the 18th Central Committee of the Communist Party of China (CPC) puts forward the "CPC Central Committee with Xi Jinping as core."

○ The National Development and Reform Commission (NDRC) indicates on Oct. 27 that China will build a traditional infrastructure PPP project information platform that connects all regions and departments.

○ Jiangsu Province is preparing to build the second provincial AMC in Suzhou to accelerate the treatment of non-performing assets. Leading shareholders are still local state-owned companies.

○ China-Boeing Aviation Industry Cooperation Forum is held on Oct. 27. Boeing signed supply agreement with Shandong Nanshan Aluminium Co., Ltd. (600219.SH) and other companies.

○ Sichuan Lutianhua Company Limited (000912.SZ) and Jiangxi Huangshanghuang Group Food Co., Ltd. (002695.SZ) announces suspending trading from Oct. 28 as their stock prices have surged.

TOP

[Industry Information].

○ Opinions on development of rehabilitation equipment released, industry expected to see rapid growth

------

The State Council on Oct. 27 issued the opinions on accelerating the development of rehabilitation aid equipment industry. It suggests that by 2020, the rehabilitation aid equipment industry should make significant improvement in the capability of independent innovation. The industry scale should exceeded 700 billion yuan. A number of well-known domestic brands and advantageous industrial clusters should emerge. Its share in the high-end market should significantly increase. It also proposes to promote the combination of medial and industry, support integrated application of artificial intelligence, brain-computer interface, virtual reality and other new technologies in rehabilitation aids equipment, and support the research and development of exoskeletal robots, care and rehabilitation robots, bionic prosthetics, virtual reality rehabilitation training equipment and other products.

Comment: The State Council executive meeting held on Oct. 14 proposed to encourage to gradually include basic rehabilitation aid equipment into the scope of basic health insurance payment. Institutions believe that as medical concepts update fast, rehabilitation equipment will become the fastest-growing one among all medical sub-sectors, and is expected to maintain more than 40% growth rate in the coming two years. HL Corp (Shenzhen) (002105.SZ) has prominent technical advantages in rehabilitation equipment. It cooperates with three major international rehabilitation equipment brands. Guangdong Jinming Machinery Co., Ltd. (300281.SZ) works with Tsinghua University to develop rehabilitation robots. Chongqing Dima Industry Co., Ltd. (600565.SH) to increase investment in exoskeleton robots.

○ Land transfer speeds up, rural land resources show values

------

The State Council recently released the national plan for agricultural modernization (2016-2020). The plan proposes to deepen the agricultural and rural reform, accelerate in promoting the registration and certification for rural contracted land right while stably improving basic operation system in rural areas, and strive to complete the reform by the end of 2018. The plan also proposes that it will improve the system on the operation management in villages in all counties and promote the management services on land transfer and scaled operation. It will actively develop operations with moderate scales in various forms, guide farmers in voluntary and orderly transfer of the operation right on lands and support the development of operations with moderate scales through land transfer and other means.

Comment: Driven by the confirmation on land right and the agricultural scaled operation, the land transfer will speed up and enterprises with land resources will see more market opportunities. Anhui Huilong Agricultural Means of Production Co., Ltd. (002556.SZ) is a leader in the trading of agricultural materials and is actively participating in land transfer. Gansu Yasheng Industrial (Group) Co., Ltd. (600108.SH), China Hainan Rubber Industry Group Co., Ltd. (601118.SH) and Heilongjiang Agriculture Company Limited (600598.SH) own huge agricultural land resources.

TOP

[Announcement Interpretation]

○ Sunwin Intelligent to buy Kaixinren Information Technology with RMB 1,085 mln

------

Shenzhen Sunwin Intelligent Co., Ltd. (300044.SZ) proposes to buy the entire equities of Beijing Kaixinren Information Technology Co., Ltd with 1,085 million yuan, which will be satisfied by cash payment of 322 million yuan and fundraising of 763 million yuan through issuing shares at 13.09 yuan per share. At the same time, the company proposes to raise supporting fund of 540 million yuan. Kaixinren Information Technology is a comprehensive Internet interactive entertainment company. It developed various social games such as Parking War, Friends for Sale, Happy Farm and Fun City. The original shareholder committed that net profits of Kaixinren Information Technology from 2016 to 2019 will be no less than 73 million yuan, 93 million yuan, 116 million yuan and 140 million yuan respectively.

○ Pearl River Holdings to purchase BGG

------

Hainan Pearl River Holdings Co., Ltd. (000505.SZ) proposes to replace part of the assets and liabilities for the entire equities of Beijing Grain Group Co., Ltd. (BGG). The valuations of the exchange-out and exchange-in assets approximates 600 million yuan and 2,419 million yuan respectively. The difference will be acquired through private placement at 8.09 yuan per share. At the same time, the company proposes to raise 600 million yuan supporting fund by issuing shares to BGG through private placement at 8082 yuan per share. BGG is primarily engaged in the process of vegetable oil and food manufacturing. The company's revenue and net profits for 2015 were 14.3 billion yuan and 130 million yuan respectively. It committed net profits from 2016 to 2018 will be no less than 124 million yuan, 141 million yuan and 160 million yuan respectively.

TOP

○ Success Electronics proposes to acquire medical assets

------

Shenzhen Success Electronics Co., td. (002289.SZ proposes to transfer the entire equities of Shenzhen Yassy Technology Co., Ltd. to Guangdong Hua long photoelectricity Technology Ltd. at the valuation ranges from 160 million yuan to 180 million yuan, which is higher than the asking price of 120 million yuan. Previously the company tried three times to clear the assets but not succeeded. Meanwhile, the company proposes to acquire 60 to 65 percent of medical supplies and equipment related assets at an estimated valuation of 540 million yuan to 715 million yuan.

○ CSF increased shareholding of several companies in Q3

------

The Q3 reports show that China Securities Finance Co., Ltd. (CSF) has increased holding about 20 million shares of China Eastern Airlines Corporation Limited (600115.SH) in Q3, and shareholding ratio was up from 2.33 percent to 2.47 percent; the CSF also increased holding 18 million shares of China Life Insurance Company Limited (601628.SH) in Q3, and the shareholding ratio was up from 2.03 percent to 2.09 percent. In addition, the CSF also increased shareholding in China National Nuclear Power Co., Ltd. (601985.SH) and Air China Limited (601111.SH).

○ Evergrande Life's shareholding in Integrated Electronic Systems Lab close to 5 percent threshold

------

Integrated Electronic Systems Lab Co., Ltd. (002339.SZ) disclosed in the Q3 report that in the latest list of shareholders, Evergrande Life has held 4.96 percent equities of the company through two accounts, namely Traditional Portfolio A and Universal Portfolio B, closing to the 5 percent threshold. In the interim report, Evergrande Life was not among the top 10 shareholders' list. Besides, Q3 report of Wuhan Zhongyuan Huadian Science & Technology Co., Ltd. (300018.SZ) shows that Evergrande Life's Traditional Portfolio A and B in total held 4.95 percent of the company's equities.

○ Q3 report of Guoguang Electric Company Limited (002045.SZ) shows that in the list of top 10 shareholders, BOCOM& Schroders has taken 6 seats, with total shareholding ratio of 7.93 percent.

○ Beijing Shouhang Ihw Resources Saving Technology Co., Ltd. (002665.SZ) has signed three big orders with total amount of 218 million yuan. The company's revenue for 2015 was approximate 1,130 million yuan.

[Financial Reports Express]

○ Neoglory Prosperity expects growth

------

Neoglory Prosperity Inc. (002147.SZ) expects 411 to 446 times growth in its annual report, primarily due to property development has become the main profit source after restructuring. Zhejiang NHU Company Ltd. (002001.SZ) expects 2 times growth in its annual report, primarily due to rise of selling price. Jiangsu Huaxicun Co., Ltd. (000936.SZ) expects over 5 times growth in its annual report, primarily due to sharp increase of investment return. Shan Dong Sun Paper Industry Joint Stock Co., Ltd. (002078.SZ) expects about 1 time growth in its annual report, primarily due to the release of production capacity. Sansteel Minguang Co. ,Ltd., Fujian (002110.SZ) expects to significantly turn deficit into profit, primarily due to the pickup of demand for steel. Henan Billions Chemicals Co., Ltd. (002610.SZ) expects 2 to 3 times growth in its annual report, primarily due to the price hike of titanium dioxide. Qingdao Haili Metal One Co., Ltd. (002537.SZ) expects 1 to 2 times growth in its annual report, primarily due to combining Union Mobile Finacial Technology Co., Ltd. (UMF) into its financial statements.

[Trading Alarm]

○ CCIC and Oriental Zhongke Integration Technology IPO to debut from Oct. 28

------

China Building Material Test & Certification Group Co., Ltd. (CTC, 732060.SZ) will offer for subscription at 10.04 yuan per share, representing PE ratio of 22.97 times. The upper limit of subscription is 22,000 shares. The company is primarily engaged in the test and certification of construction materials. Beijing Oriental Zhongke Integration Technology Co., Ltd. (002819.SZ) will offer for subscription at 4.96 yuan per share, representing PE ratio of 22.95 times. The upper limit of subscription is 11,000 shares. The company is primarily engaged in electronic measuring instrument.

TOP

Latest comments